Asset-Backed Securitization

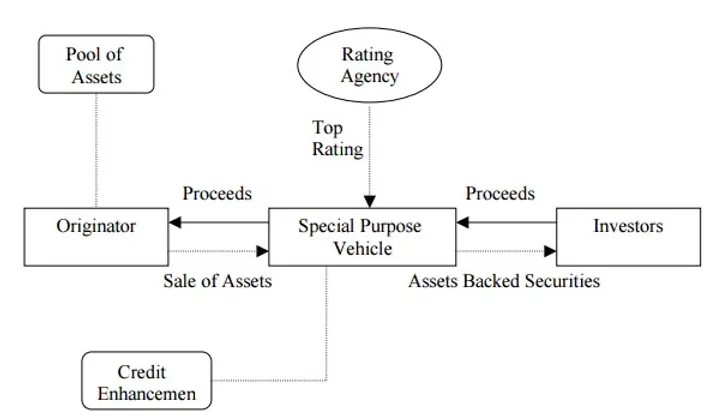

In asset-backed securitization, a Special Purpose Vehicle (SPV) will be set up to hold income-generating assets. The SPV’s shares are to be wholly owned by the Share Trustee, who manages them for the beneficiaries under a share trust agreement.

Pacific Trustees acts as the legal owner of the SPV shares, ensuring the SPV asset use for repayment or project financing, following the Trust Deed and Malaysian trust laws. We specialize in complex securitization and restructuring with government-linked companies and financial institutions.

We also provide Independent Directorship services to maintain the SPV’s operations and protect it from legal issues. As Transaction Administrator, we manage fund investments, prepare reports, handle payments, and oversee designated accounts.

Special Purpose Vehicle (SPV)

In a typical asset securitisation transaction, a company is incorporated with a view to owning certain income-producing assets (via a special purpose vehicle or SPV). Shares in the SPV are then issued to the Share Trustee by way of a discretionary and irrevocable trust for the benefit of the Beneficiaries upon the terms and conditions of the Trust Deed.

Share Trustee

Pacific Trustees holds the legal ownership as Share Trustee for identified Beneficiaries in respect of assets to be transferred for a purpose or disposal of asset for repayment or holding shares for the proceeds to be utilised for repayment or financing of certain project pursuant to the provisions of the Declaration of Trust and relevant trust laws in Malaysia. We have a pool of expertise with key skills in complex restructuring schemes and asset securitisation involving government-linked companies as well as banking and financial institutions.

Independent Directorship

We also provide independent directorship services whereby we act as directors of the SPV and do such acts and sign such documents as may be required to be done or signed by the SPV or any of its directors. Furthermore, we do all acts necessary within our powers to ensure the SPV continues as a going concern throughout the tenure of the asset-backed securitisation, including but not limited to, defending or setting aside all actions, suits, claims, winding-up, execution, foreclosure and arbitration proceedings instituted against the SPV.

Transaction Administrator

We also have hands-on experience as a Transaction Administrator mainly involving Asset-Backed Securitisation structure where our duties include:

- Executing instructions for investment of funds on deposit in the Designated Accounts based on the recommendation of the Servicer;

- Preparing monthly reports to specified transactions and their monitoring;

- Receiving Servicer reports indicating scheduled collections, actual collections, delinquencies, defaults, etc;

- Reviewing certain confirmations on the Servicer reports and completing cash and account reconciliation;

- Completing “waterfall” payment calculations of Issuer such as calculations of principal, interest, reserve account and other “waterfall” payments and disbursement prepared by the Lead Arranger as and when necessary;

- Making regular payments and disbursements per “waterfall” calculations, as appropriate, to Trustee, Bondholders, Servicers, back-up Servicers, credit enhancers, and recipients of other fees and expenses, as well as disbursing excess funds to the Seller/Originator and maintaining records relating to such calculations, payments and disbursements as prepared by the Lead Arranger;

- Preparing Transaction Administrator’s Reports indicating “waterfall” payments and disbursements and any other information as required on a monthly, quarterly, or half yearly basis, and distributing the same to relevant parties, i.e. Rating Agencies/Issuer in accordance with the specimen format; and

- Monitoring and operating the designated accounts.